Save today for tomorrow's discoveries.

Take the first step with Alaska 529.

Whatever sparks your child's imagination and curiosity, we can help you save for it.

Alaska 529 is an education savings plan designed to make it easy for parents and loved ones to save for education.

One Plan Many Paths.

You can use your Alaska 529 account tax-free for education expenses1 wherever your loved one's path takes them.

-

529 funds can be used for expenses at K-12 public, private, and religious schools, including:

- K-12 tuition

- Curriculum and curriculum materials

- Books or other instructional materials

- Tuition for tutoring or educational classes outside the home

- Fees for certain standardized tests

- Fees for dual enrollment in an institution of higher education

- Certain educational therapies for students with disabilities

-

Withdrawal maximum is $10,000 per year, per beneficiary. Beginning on January 1, 2026, the annual limit will increase to $20,000.

-

While qualified withdrawals from 529 plans for K-12 expenses are federally tax-free, state tax treatment will vary and could include state income taxes assessed, the recapture of previously deducted amounts from state taxes, and/or state-level penalties.

Use your 529 savings for pay for certificates, books, fees, equipment, and other supplies needed for apprenticeships. To qualify, all apprenticeships must be registered with the U.S. Department of Labor. There are no withdrawal minimums or maximums.

Use your 529 savings for vocational or trade school, community colleges, and certificate programs to pay for qualified expenses, including tuition, fees, housing, meal plans, books, supplies, computer technology, and equipment. Use the Federal School Code Search on the FAFSA website to search for a complete list of eligible institutions. There are no withdrawal minimums or maximums.

Use your 529 savings for any college or university in the U.S. as well as some international schools to pay for qualified expenses, including tuition, fees, housing, meal plans, books, supplies, computer technology, and equipment. Use the Federal School Code Search on the FAFSA website to search for a complete list of eligible institutions. There are no withdrawal minimums or maximums.

Use your 529 savings for graduate school to pay for qualified higher expenses including tuition, fees, housing, meal plans, books, supplies, computer technology, and equipment. Use the Federal School Code Search on the FAFSA website to search for a complete list of eligible institutions. There are no withdrawal minimums or maximums.

Tax-free 529 withdrawals are limited to a $10,000 lifetime cap when used for repayments of principal and interest on qualified education loans for your beneficiary or the beneficiary's sibling.

-

529 funds can be used for expenses associated with obtaining and maintaining a recognized postsecondary (post-high school) credential through a recognized postsecondary credential program.

-

Assets can be used for tuition expenses; fees (i.e. program fees, testing fees, and continuing education fees); books, supplies, and equipment required for the enrollment or attendance in a recognized program.

-

What are recognized programs?

- Programs authorized under the Workforce Innovation and Opportunity Act (WIOA)

- A Web Enabled Approval Management System (WEAMS) program listed by the Veterans Benefits Administration

- A program providing training for an examination to obtain/maintain a credential administered by a widely recognized, reputable credentialing organization

- A program identified by the Secretary of Education as being a reputable program for obtaining a recognized postsecondary credential

-

What are recognized postsecondary credentials?

- Credentials issued by a program accredited by the Institute for Credentialing Excellence, the National Commission on Certifying Agencies, or the American National Standards Institute

- Any credential included in the Credentialing Opportunities On-Line (COOL) directory of credentialing programs maintained by the Department of Defense

- Any credential that is identified by the Secretary of Education as being industry recognized

- A certificate of completion of an apprenticeship registered and certified under the National Apprenticeship Act

- Any occupational or professional license issued or recognized by a state or by the federal government

- A recognized credential defined under the Workforce Innovation and Opportunity Act

If you have questions about the impact of these changes on your specific situation, be sure to speak with a qualified tax professional.

Take the next step with Alaska 529

Alaska 529 has made it easy to save for education.

Open an account

You can open an account with an initial, recurring, or PFD contribution. Choose an initial or recurring contribution of at least $25 and you may be eligible for a $250 Dash to Save® incentive contribution.2

Invest your way

Contribute as much or as little as you want and choose from a range of investment portfolios.

View investment optionsStay on target

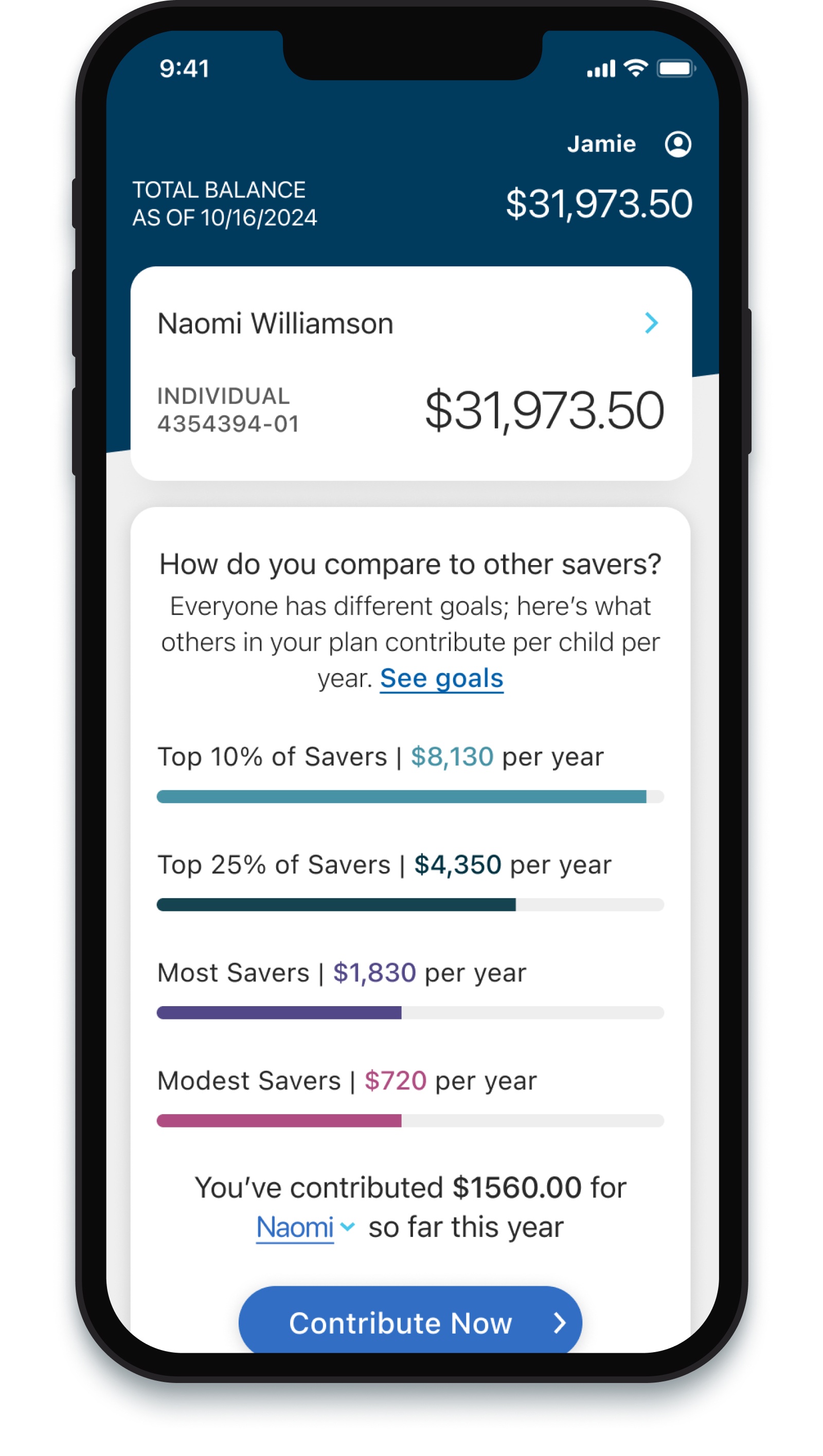

We offer online tools and resources to support you in reaching your education savings goals.

Learn more

Manage your account anywhere, anytime with the READYSAVE™ 529 app.

-

Contribute at your pace

Add money to your balance as a one-time or recurring contribution.

-

Regularly monitor your account

Check your account balance, transaction history, and investment allocations.

-

Gifting from friends and family

Easily invite friends and family to help give your savings a boost with Ugift®.